The price gap is real between Canada and the US

Canadian consumers are right, there is a price gap between the cost of goods in Canada and cost of goods in the United States. This has been an issue that retail buyers, wholesale reps and Canadian distributors have been struggling with for well over a decade.

Most Canadian cities are located within a few hours of the US border. Better sales, better brands, and better pricing have been consistent reasons cited by customers for shopping in the US, instead of Canada. Although there is better brand availability in Canada, pricing is still a concern.

The retail industry has largely attributed higher taxes, shipping, customs and duty for this perception. But a new Statistics Canada Report indicates that the before-[consumer-]tax price of non-regulated goods is almost 25 percent higher.

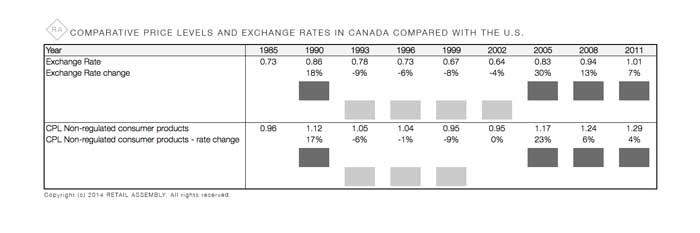

The CPL, or comparative price level is a ratio of the final selling price in Canada to the final selling price in the US – adjusting for the difference in currency exchange. The CPL in 2011 of 1.25, pre-tax, indicates consumer goods were priced 25 percent higher in Canada than the US.

And there is a relationship with the currency exchange rate. As the value of the Canadian dollar rises, so does the price of goods in Canada compared with the US. In 2002, when the dollar was at US$0.64, CPL was 95 percent. When the exchange reached US$1.01 in 2011, the CPL also rose to be 29 percent higher than the US standard.

COMPETITIVE CANADA

With price parity still out of reach for Canadian consumers, relative prices fluctuating with currency rate changes, a delayed adoption of e-commerce, free shipping from the US, and an influx of American retailers into the country – the industry up north certainly has its challenges.

Target Canada launched over 100 stores in the country in the last year, with prices higher than in their US stores. Overall, the retailer lost over $1billion in the first year, for a variety of reasons, but customer’s overall disappointment in pricing is perhaps one of them. They’ve recently replaced the CEO, and it will be interesting to see how they address the parity issue. Perhaps a lower operating margin to achieve comparable US – Canada retailers is on the table to help ensure market-share growth.

The Weekly newsletter sign-up.