In the midst of change at the big 4 surf brands

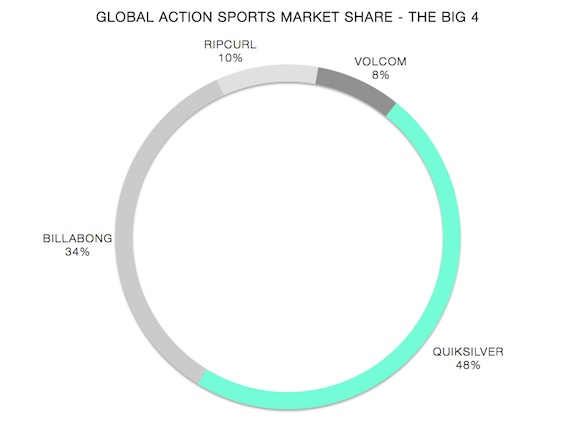

No one would deny the action sports world is undergoing a significant shift. After years of unstoppable growth, acquisitions, and brand extensions, the industry has found they have spread themselves too thin.

Sales in core brands has slowed, while profit margins have declined (if not entered into negative territory). In search of financing, at least two of the major four brands – Billabong and Ripcurl - declined to reach a deal in a ‘hostile’ IPO and buy-out market.

2013 was the year the industry took a good look at itself, and outlined how they would adjust and transform their businesses to remain relevant to a younger audience.

Fiscal 2013 results

Much of the media coverage has been focused on changing and uncertain executive posts. Quiksilver replaced 7 of the 10 executive posts in 2012-2013 with leaders from strong global brands (i.e. Nike, Disney, etc.). From 2012 Billabong has seemed uncertain about the permanence of the leadership in the CEO post. What was underestimated in the coverage were the subtle, yet significant shifts in the ways these brands do business. Kelly Slater moving on from a 20+ year relationship with Quiksilver is a perfect example.

Sounding similar to many retilers strategy statements, Quiksilver’s 2013 profit improvement plan outlines a focus on core brands, the reallocation of marketing to social, and a shift from a regionally to globally managed company. Here’s how it breaks down.

FOCUS ON CORE BRANDS

The core brands for the organization are Quiksilver, Roxy and DC – the girls surf line showing the largest growth as of late. Quik has already exited its womens contemporary business, Dane Reynolds’ Summer Teeth, VSTR and Hawk. Muskova, Lib Tech, GNU, surfdome, and the iconic Maui and Sons are left. They’ve all be noted as “not significant”, with Maui and Sons also receiving an ‘x’ instead of a check for sustainability.

MARKETING STRATEGY

In 2013 alone, Quiksilver released 100+ athletes and cancelled numerous event sponsorships. In 2012 the company estimated that they spent only 15 percent of their marketing budget on activities related to product “demand creation”, and 50 percent on athletes and events. By 2013 Quiksilver estimates their demand spend will be closer to 70 percent, with athletes and events making up 10 percent of spend (salaries and T&E make up the rest). Cue the Kelly Slater announcement.

No one in the industry today would fault a shift to social media spend, such a drastic move will have larger industry implications.

Action sports are an industry that has built its growth and popularity through event and athlete sponsorship. If the big three aren’t going to do this, we’re not sure who is. While this may be the right decision for the company, the move won’t do much for strengthening or growing the size of the market.

It’s always better to grow the size of the pie before dividing it up. The big 4 may just be competing for market share at this point.

SUPPLY CHAIN OPTIMIZATION

This is where great work is being done. Previously only 20 percent of Quiksilver styles were globally available, as much of the design and purchase orders were written regionally. The company was developing 51,000 styles annually.

Consistent brand identity is easily achieved with one collective voice and one product offering. Weather requires some variations, but the goal of reaching 70 percent global styles seems both a prudent use of design resources, and a wiser move to develop global brand strength.

Demand and merchandise planning are also being done at a global level will which allow the company to achieve better pricing and delivery as they will now have more significant volume. Reducing their vendor base by over a third – and utilizing them across brands, will also allow for greater simplicity throughout the supply chain, and the pricing efficiencies mentioned above. This aggregated factory model will also allow the organization to push more responsibility to the supplier-level, including pre-packing for larger retail clients.

Of course, it wouldn’t be a sourcing strategy in 2013 without talk of shifting production to lower cost countries. While we have mixed feelings about this, because the skill in each of these low-cost regions (Bangladesh, Indonesia) is still developing. A certain quality of product needs to be maintained.

SALES EFFICIENCY

Fiscal 2014 Q1 results for Quiksilver

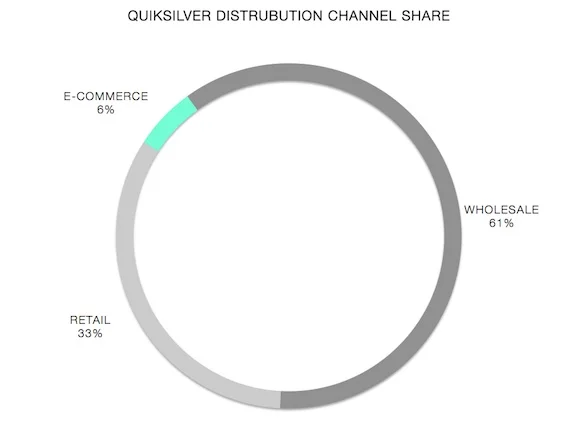

This year, 2014 first quarterly losses are coming from the wholesale channel, which decreased by 7 percent. This may be a result of true demand for the product, or a shift in wholesale sell strategy. In 2013 the company switched to a single sales team to support all brands.

Direct to consumer channels showed the best growth for the first quarter this year, comp store sales increased by 2 percent, while the total retail channel increased by 4 percent. E-commerce, as expected, is the fastest growing channel at 16 percent.

QUIK IS NOT ALONE

Billabong is going through a similar restructure, although with less certainty. The brand has been plagued with buy-out and share sale talks since 2012, with uncertainty surrounding the CEO post.

Similarly, the company is in the process of shedding excess weight. Billabong has successfully extinguished future purchase obligations with Nixon, sold Canadian Chain West 49 to YM Inc., and shuttered the doors on 158 under performing retail stores.

Reducing supplier base by 75 percent while focusing on the “core business” will also help the brand achieve efficiency in pricing and operations. The brand will retain its regional organization – Americas, Europe, and Australasia.

Operationally, both Quiksilver and Billabong are doing the right things to ensure they remain in business for the next decade and beyond. Coming off of a local focus and emphasis on new brands, the businesses are cycling around to their core competencies.

What we look forward to next are the conversations around innovation, which is what will be needed to maintain their relevancy in the market. Technical fabric innovation, design innovation, and lifestyle innovation.