China's after-sales service

As China's luxury market continues to grow at a rapid pace, the sales and service infrastructure is struggling to keep up. A World Luxury Association survey recently indicated that after-sales complaints in China are on average 65 percent higher in China than Europe. This gap in service level experienced at home vs overseas for Chinese consumers is starting to impact luxury spending. Spending is slowing in China - 2012 showed 7 percent growth year-over-year versus spending overseas at 37 percent.

Luxury items are mostly rare and expensive, and their appeal to Chinese shoppers, particularly to the hard-working middle class, is great because they are perceived as a reflection of the owner's personal values.

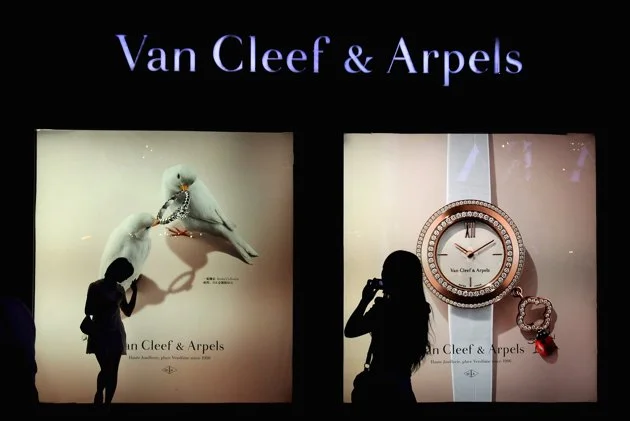

Jeff Gong has been a vocal advocate for equal customer service levels, regardless of geographic location, writing in China daily, "Luxury items are mostly rare and expensive, and their appeal to Chinese shoppers, particularly to the hard-working middle class, is great because they are perceived as a reflection of the owner's personal values". He specifies that a customer who purchases a watch at an Omega boutique in Milan can receive a battery replacement at no charge, in contrast to the 200 Euro fee that applies at an Omega store in China. In addition, French jeweller Van Cleef & Arpels' complimentary lifetime maintenance in Europe translates to longer waits and fees in China, and Vera Wang recently made headlines when their flagship store began charging clients to try on dresses (a policy which was quickly reversed).

As the industry continues to develop in China, the after-sales care will surely catch up. In the meantime, Richemont's "retail academy" in Shanghai, which educates staff and managers on professional skills and techniques appropriate for luxury sales, is a great solution.