Sephora is a highlight in the LVMH portfolio

Sephora, Beijing

As Louis Vuitton's sales performance growth slows from West to East, LVMH continues to grow it's portfolio of companies which appeal to a wider audience.

Louis Vuitton, the flagship brand, is beginning to appear oversold, particularly in China. David Sadigh, CEO of Digital Luxury Group told Forbes in June that many luxury brands are still growing in the Chinese market. This is in contrast with Louis Vuitton which has pulled back its expansion plans for the near future, while the brand continues to see modest sales growth.

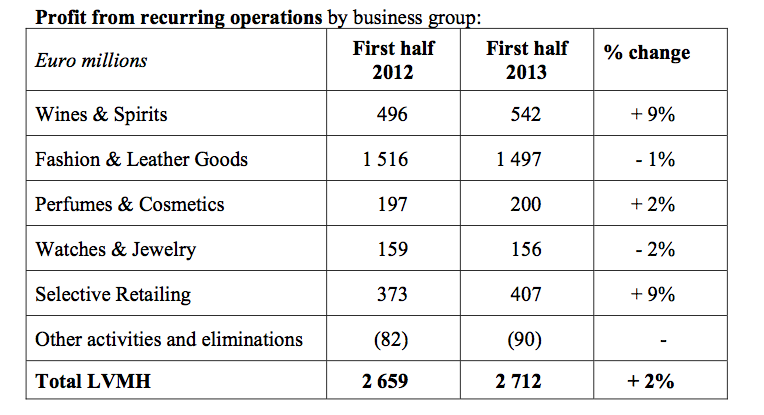

Sephora, as part of the Selective Retailing business group, achieved organic revenue growth of 19 percent. This out-indexes the total for LVMH's 2 percent. The Fashion & Leather Goods group achieved only 5 percent revenue growth, and a decline of 1 percent in profit for the same period last year. In North America Sephora continues to strengthen its position and innovate in the digital sphere. A flagship has been recently opened in Shanghai, and the retailer has begun its expansion in India.

Catering to beauty buyers through fragrance and cosmetics is a smart move, as these products give mass-market consumers and entry-point into the luxury sphere. Sephora's combination of exclusive product offerings, exclusive size options for products with wider availability, and a strong private label are the aspects in which the company is able to maintain control of pricing (with less pressure to discount to keep up with direct competitors. Many analysts agree, Sephora will continue to be LVMH's cash cow in the short-term.

The world's best retailers, producers, and brands are used both as case studies, and resources in our online courses and workshops. If you want to get deeper into the industry - check them out.

Meanwhile, sign up for The Weekly newsletter.